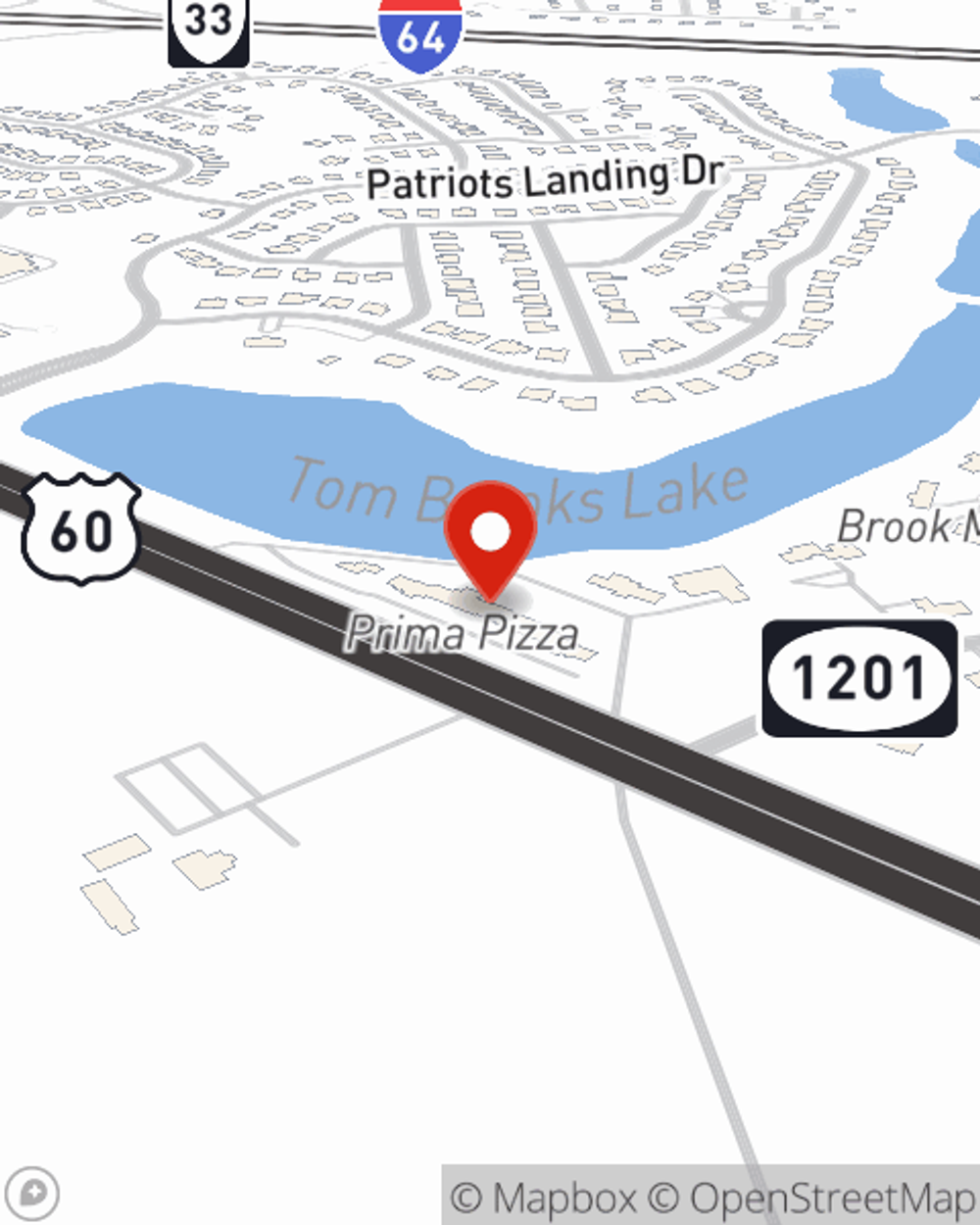

Business Insurance in and around Quinton

One of the top small business insurance companies in Quinton, and beyond.

Almost 100 years of helping small businesses

- Quinton

- New Kent

- Providence Forge

- Charles City

- Lanexa

- Barhamsville

- Sandston

- Varina

- Highland Springs

- Ruthville

- West Point

- Toano

- Williamsburg

- Norge

- Mechanicsville

- Old Church

- Talleysville

- Richmond

- Henrico

- Rocketts Landing

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of wins and losses. You shouldn't have to work through those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including business continuity plans, a surety or fidelity bond and errors and omissions liability, among others.

One of the top small business insurance companies in Quinton, and beyond.

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a gift shop, a window treatment store or an antique store. Agent Becky Ringley is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Reach out agent Becky Ringley to learn more about your small business coverage options today.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Becky Ringley

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.